Forex Tester Online Review: The Ultimate Cryptocurrency Backtesting Platform?

Introduction

In the fast-paced world of cryptocurrency and financial markets trading, one costly mistake can wipe out weeks of profits. The harsh reality? Most traders lose money not because they lack knowledge, but because they skip the most critical step: backtesting their strategies against real historical data.

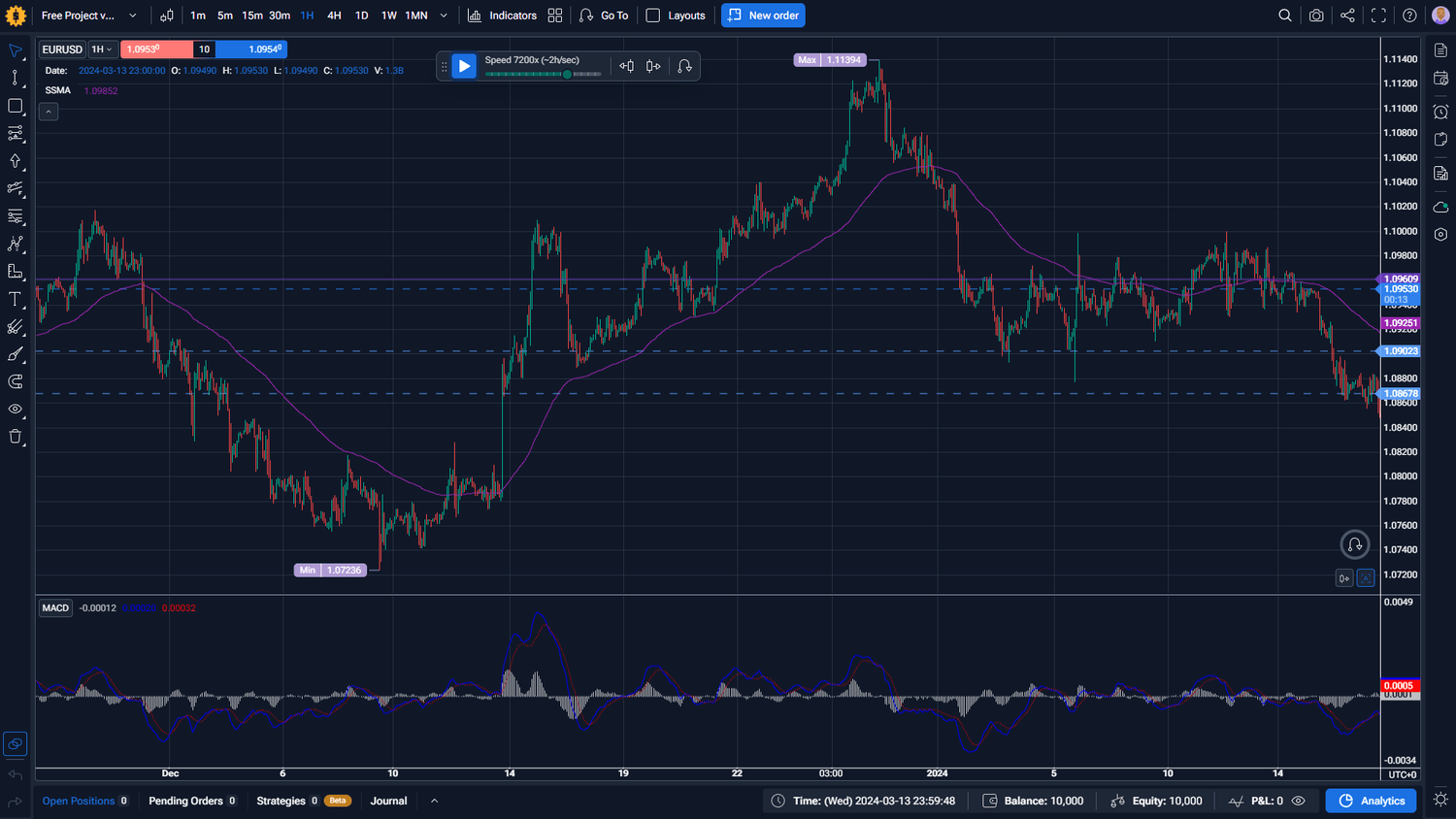

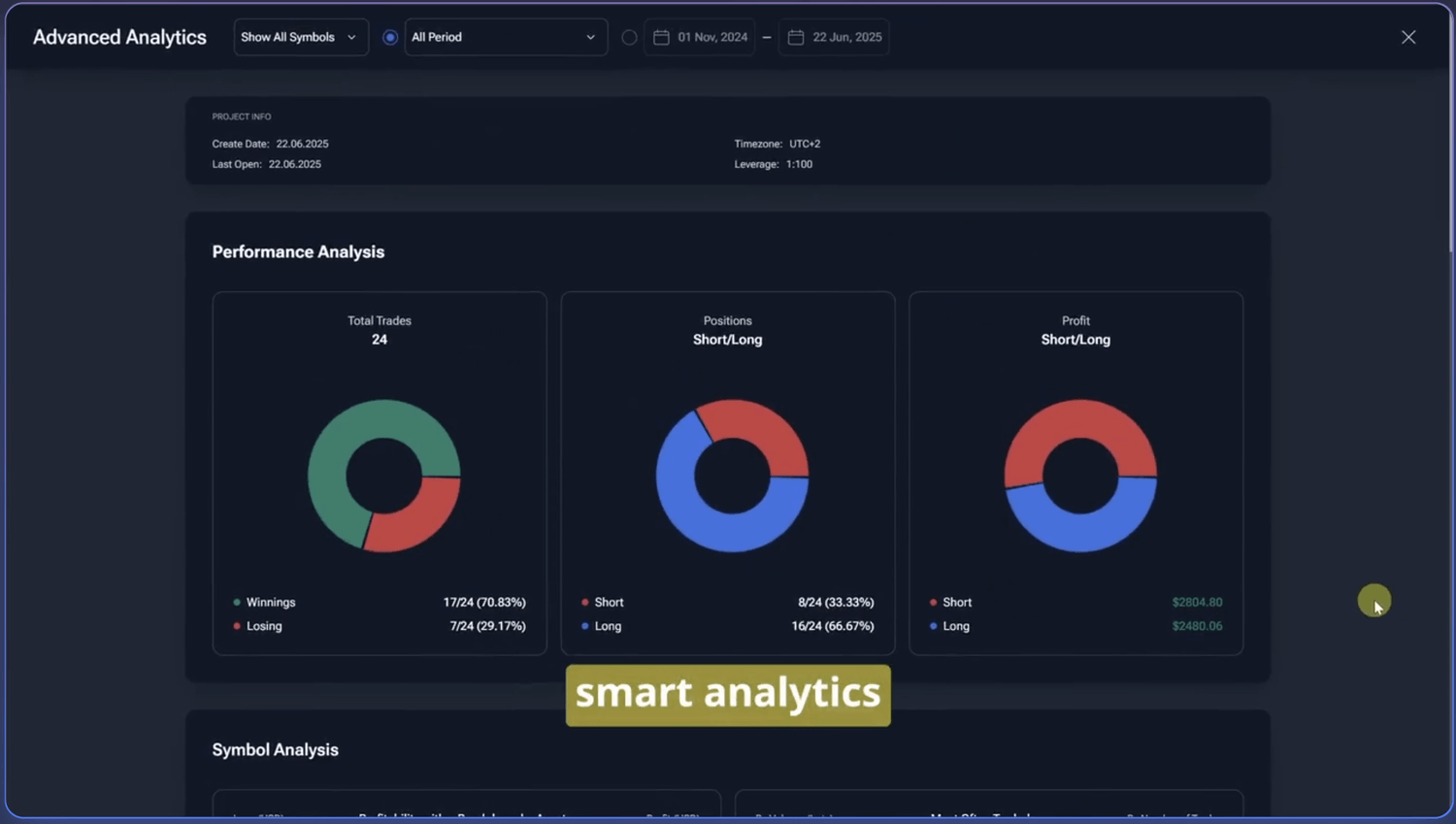

Figure 1. Forex Tester Online: Chart with Indicators

Traditional backtesting methods—manually scrolling through charts or using spreadsheets—are time-consuming, error-prone, and often miss the nuances of real market conditions. Live trading without proven strategies is essentially gambling with your capital.

Enter Forex Tester Online, a cloud-based backtesting platform that promises to revolutionize how traders develop and validate their strategies. But does it live up to the hype, especially for cryptocurrency traders who face unique market challenges?

This comprehensive review examines Forex Tester Online's capabilities, with a primary focus on cryptocurrency backtesting (60% of use cases), stock market testing (30%), and forex simulation (10%). We'll evaluate its features, pricing, and whether it's worth the investment for serious traders.

What is Forex Tester Online?

Forex Tester Online (FTO) is a web-based trading simulator that allows traders to backtest strategies using historical market data without risking real capital. Unlike traditional desktop applications, FTO runs entirely in your browser, eliminating installation hassles and enabling cross-device access.

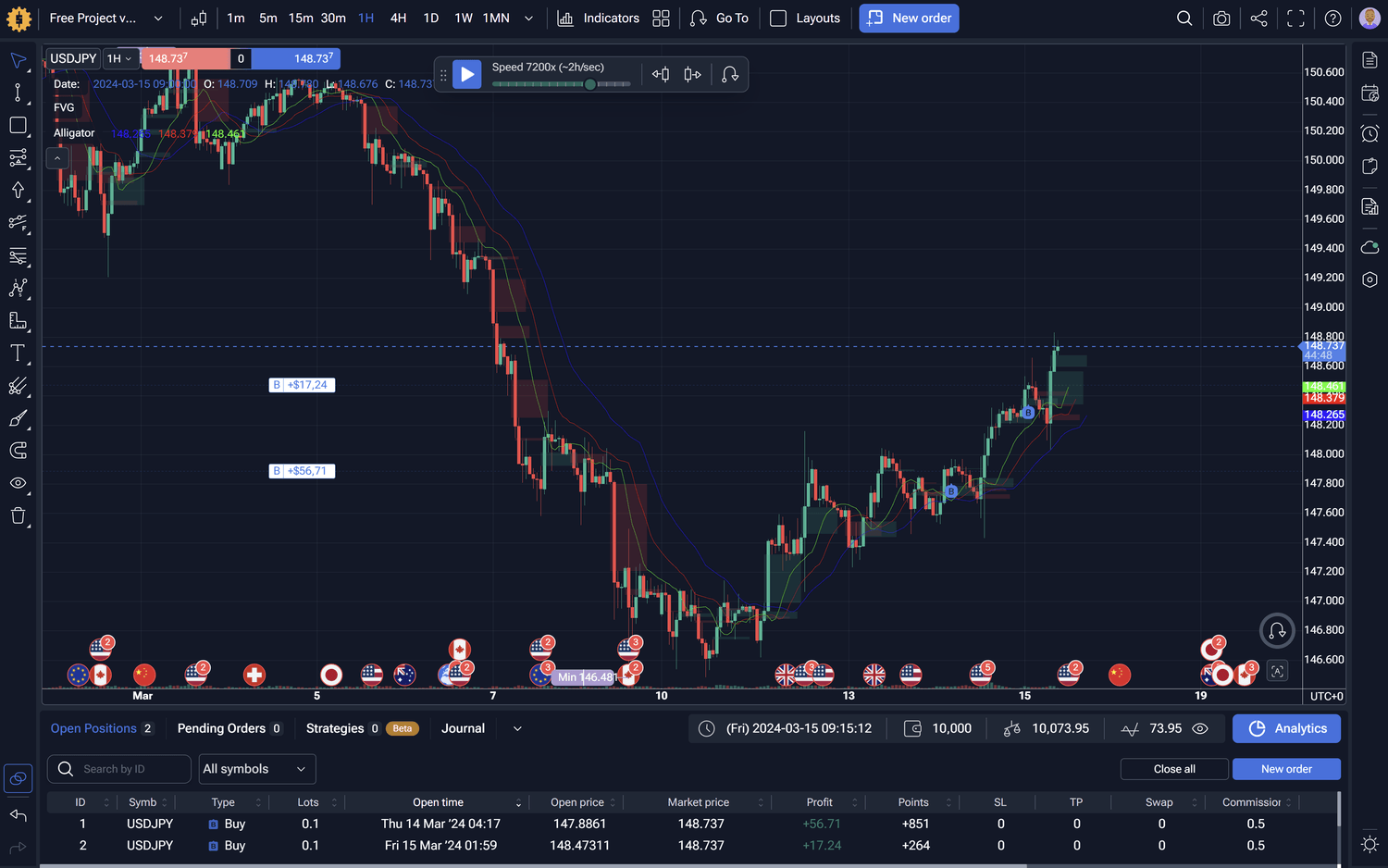

Figure 2. Forex Tester Online: Backtesting with Trades

Key Differentiators:

Cloud-Based Architecture: Access your testing projects from any device with an internet connection

No Installation Required: Start testing immediately through your web browser

Tick-Level Data Precision: Simulate realistic market conditions with tick-by-tick price movements

Multi-Asset Support: Test strategies across cryptocurrencies, stocks, forex, commodities, and indices

Unlimited Project Storage: Save and revisit unlimited backtesting projects in the cloud

The platform is designed to bridge the gap between theoretical strategy development and real-world execution, providing a risk-free environment where traders can refine their approaches before committing actual capital.

Core Features & Capabilities

Data Quality & Market Coverage

Forex Tester Online provides access to extensive historical market data spanning over 20 years:

Available Instruments:

Cryptocurrencies: 31+ crypto pairs including BTCUSD, ETHUSD, BTCEUR, LTCUSD, and more

Stocks & Indices: Major global indices and individual stocks

Forex Pairs: 80-727 currency pairs depending on subscription tier

Commodities: Gold, silver, oil, natural gas

Futures: Various futures contracts

Data Resolution:

Tick-Level Data (Pro Plan): Every single price change captured for maximum accuracy

Minute-Level Data (Starter Plan): 1-minute OHLC bars with volume

Historical Depth: Up to 21+ years of historical data

Floating Spreads: Variable spreads that reflect real market conditions

Critical Note for Crypto Traders:

Cryptocurrency pairs are not available in the Free Demo. To access Bitcoin, Ethereum, and other crypto instruments, you’ll need a paid subscription (Starter or Pro plan). The free demo is limited to 2 forex pairs: EURUSD and USDJPY.

Backtesting Engine & Simulation Precision

The platform’s simulation engine is built to replicate real market conditions:

Order Execution Features:

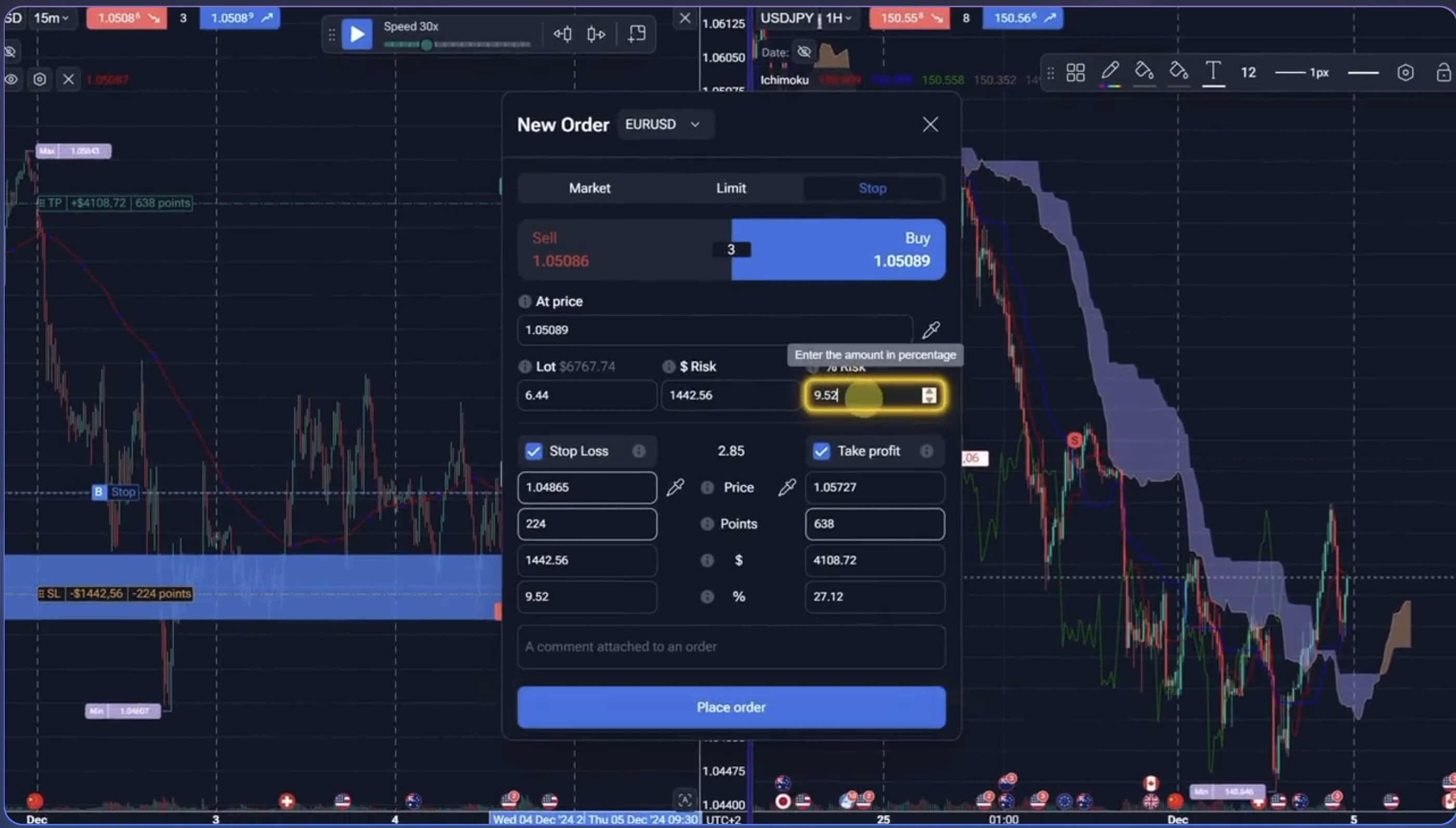

Manual Order Placement: Click, drag, and drop orders directly on charts

Stop-Loss & Take-Profit: Set protective orders with visual management

Partial Position Closing: Scale out of positions like in live trading

Order Modification: Adjust pending orders in real-time during simulation

Margin Calculations: Accurate margin requirements based on leverage

Time Controls:

Variable Speed Playback: Test from 1 second to 1 day per second

Jump to Date/Time: Instantly teleport to specific historical moments

Bar-by-Bar Navigation: Step through price action one candle at a time

Bar Back Function: Rewind to review previous price movements

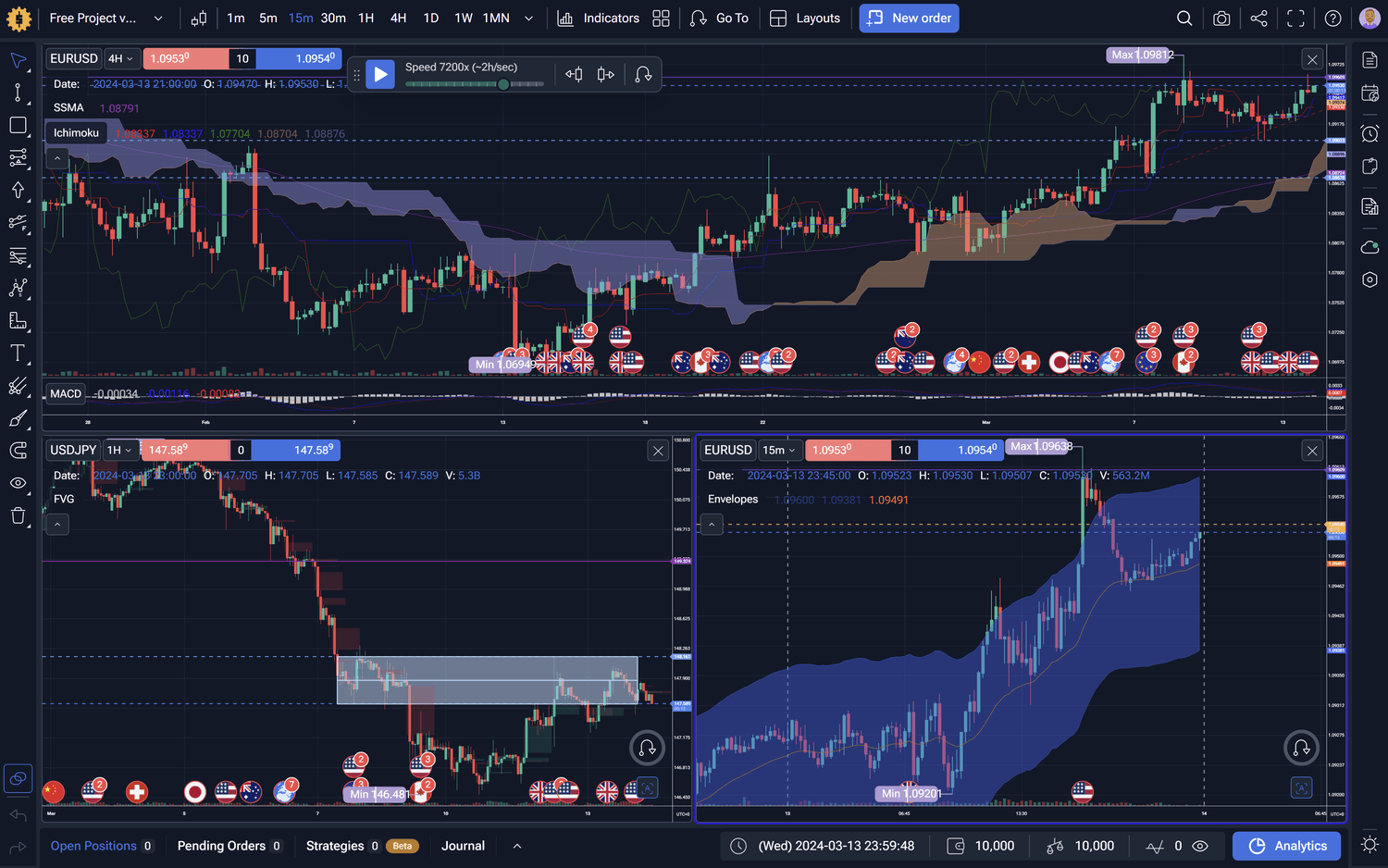

Figure 3. Forex Tester Online: Entering Order

Multi-Chart & Workspace Management

Professional traders need to monitor multiple timeframes and instruments simultaneously:

Up to 10 Charts Simultaneously: Analyze correlations and multi-timeframe setups

Chart Synchronization: Link charts to move crosshairs across all timeframes

Template System: Save and apply chart layouts, indicators, and drawing tools

Unlimited Indicators: No restrictions on the number of indicators per chart

Custom Indicators Supported: Import your own technical indicators

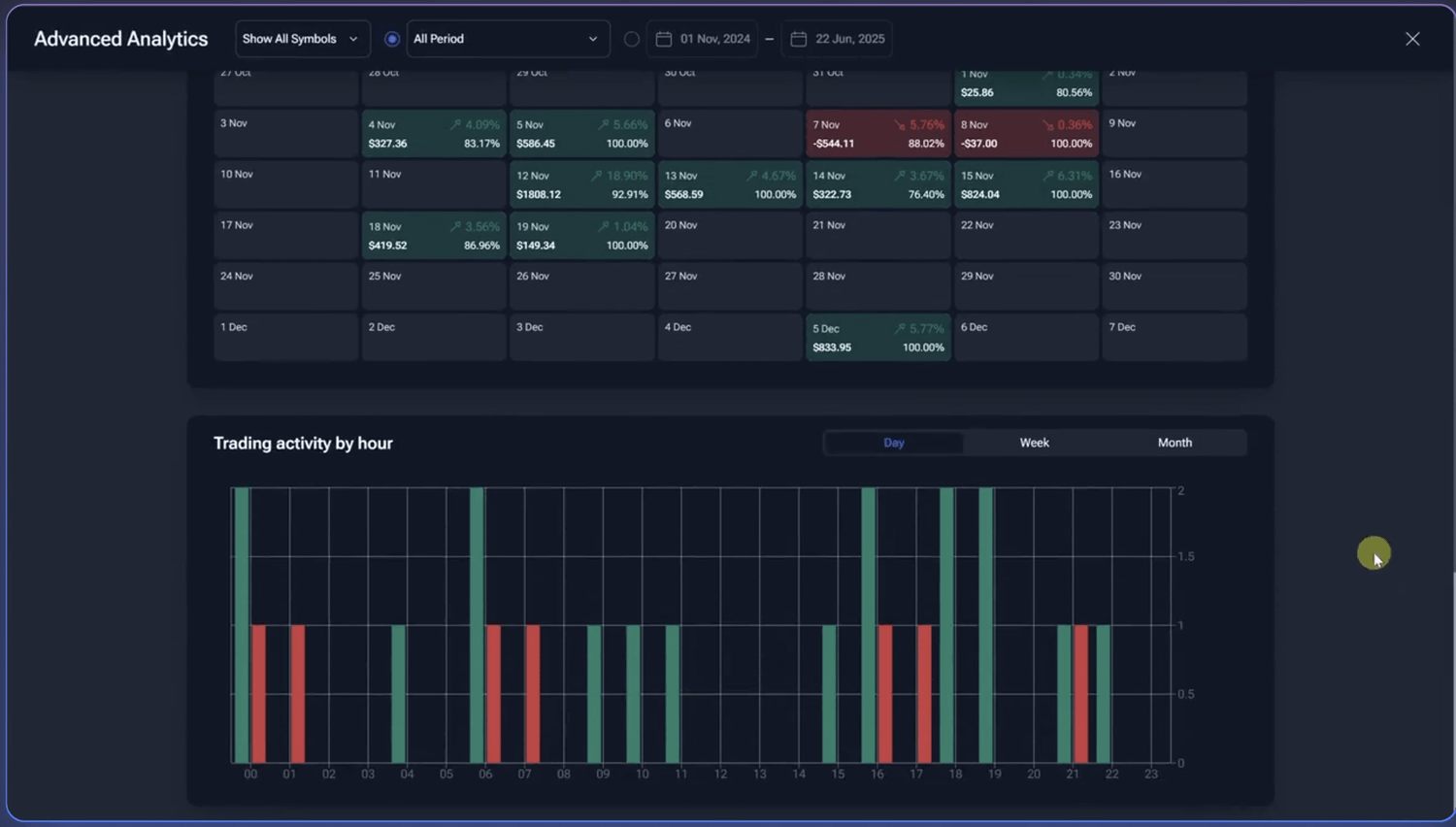

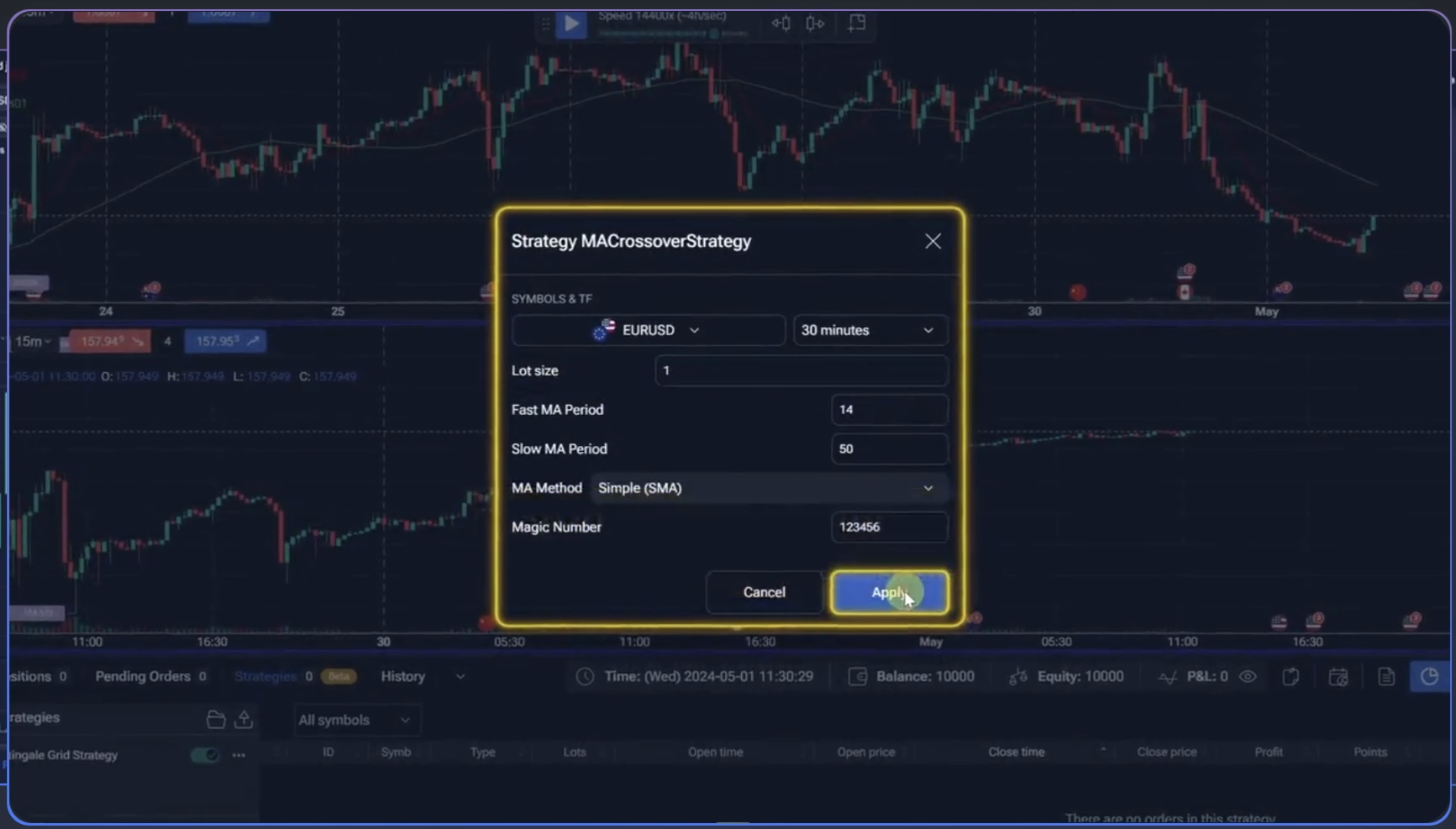

Analytics & Performance Reporting

Understanding your strategy’s performance is crucial:

Available Metrics:

Starting capital vs. ending balance

Total profit/loss in currency and percentage

Number of trades (winning vs. losing)

Win rate and profit factor

Maximum drawdown

Average trade duration

Risk/reward ratios

Export Capabilities:

CSV export for external analysis

Excel-compatible formats

Detailed trade history logs

Figure 4. Forex Tester Online: Advanced Analytics

Cryptocurrency Backtesting: The Primary Use Case

For cryptocurrency traders, Forex Tester Online offers specialized capabilities that address the unique challenges of crypto markets.

Available Cryptocurrency Pairs

The platform supports 31 cryptocurrency instruments, including:

Major Crypto Pairs:

BTCUSD (Bitcoin/US Dollar)

BTCEUR (Bitcoin/Euro)

ETHUSD (Ethereum/US Dollar)

LTCUSD (Litecoin/US Dollar)

Plus 27+ additional crypto pairs

Important Limitation: These crypto pairs are only available in paid subscription plans (Starter and Pro). The Free Demo is restricted to EURUSD only.

Why Crypto Backtesting Matters

Cryptocurrency markets operate 24/7 with extreme volatility. A strategy that works during calm periods may catastrophically fail during high-volatility events. Backtesting allows crypto traders to:

Test Strategies Across Market Cycles: Validate performance during bull markets, bear markets, and ranging conditions

Optimize Entry/Exit Timing: Refine precise entry and exit points using historical data

Understand Drawdown Risks: Identify maximum capital drawdowns before risking real funds

Develop Risk Management: Calibrate position sizing and stop-loss levels

Save Time and Capital: Compress months of live trading experience into days of simulation

Crypto-Specific Features

Tick-Level Precision for Volatile Markets:

Cryptocurrency markets can move several percentage points in seconds. The Pro plan’s tick-level data captures every single price change, crucial for:

Scalping strategies

High-frequency trading approaches

Precise stop-loss hunting analysis

Micro-movement pattern recognition

24/7 Market Simulation:

Unlike forex markets that close on weekends, crypto markets never sleep. FTO accurately simulates continuous 24/7 trading, including:

Weekend volatility events

Overnight gap analysis (minimal in crypto)

Holiday trading conditions

Floating Spread Modeling:

Cryptocurrency spreads can widen dramatically during volatility spikes. FTO models variable spreads that reflect real market conditions, preventing unrealistic backtest results.

Figure 5. Forex Tester Online: Portfolio Analytics

Realistic Crypto Backtesting Workflow

Step 1: Create a Crypto-Focused Project

Select BTCUSD, ETHUSD, or your preferred crypto pair

Set initial capital (e.g., $10,000)

Choose historical date range (recommend minimum 1 year)

Configure spread and commission settings

Step 2: Apply Your Strategy

Add technical indicators (RSI, MACD, Moving Averages, etc.)

Draw support/resistance levels

Set up entry and exit rules

Define risk management parameters

Step 3: Execute Simulation

Use variable speed playback (test weeks in minutes)

Execute trades based on your strategy

Track performance in real-time

Adjust strategy as needed

Step 4: Analyze Results

Review comprehensive analytics

Identify winning patterns

Eliminate losing scenarios

Export data for deeper analysis

Step 5: Refine and Retest

Adjust parameters based on findings

Test across different market periods

Validate consistency across bull/bear cycles

Advanced Crypto Testing Scenarios

Pre-Built Historical Events:

FTO includes pre-configured scenarios for major market events:

COVID-19 Market Crash (March 2020)

Bitcoin halving events

Major volatility spikes

Regulatory announcement impacts

Test how your strategy would have performed during these critical moments.

Multi-Crypto Portfolio Testing:

Professional traders diversify across multiple cryptocurrencies. With up to 10 simultaneous charts, you can:

Monitor BTCUSD, ETHUSD, and LTCUSD correlation

Test portfolio rebalancing strategies

Identify leading/lagging crypto pairs

Develop inter-crypto arbitrage approaches

Stock Market & Index Testing

Beyond cryptocurrencies, Forex Tester Online provides robust capabilities for stock and index traders.

Available Stock Market Instruments

The platform supports major global indices and individual stocks:

Major Indices:

S&P 500

NASDAQ

Dow Jones Industrial Average

FTSE 100

DAX

Nikkei 225

Individual Stocks: Access varies by subscription plan, with the Pro plan offering the most comprehensive coverage.

Figure 6. Forex Tester Online: Charts with Multiple Timeframes

Stock-Specific Backtesting Features

Fundamental Event Integration:

Unlike pure technical platforms, FTO overlays fundamental events:

Earnings announcements

Economic data releases

Federal Reserve decisions

Geopolitical events

This allows traders to understand how news impacts technical patterns and price action.

Dividend & Corporate Action Handling:

The platform accounts for:

Stock splits

Dividend adjustments

Merger/acquisition events

Ensuring backtest accuracy for long-term stock strategies.

Use Cases for Stock Traders

Swing Trading Strategies: Test multi-day position holds across different market conditions

Breakout Systems: Validate breakout entry and exit timing

Sector Rotation: Analyze index correlations and sector leadership

Options Strategy Development: Use stock backtests to inform options strategies (though options themselves aren’t directly supported)

Forex Trading Simulation

While the platform’s name suggests forex focus, FTO’s forex capabilities represent approximately 10% of this review’s emphasis, given the target audience.

Forex Pair Coverage

Available Pairs by Tier:

Starter Plan: 80 forex pairs (majors, minors, some exotics)

Pro Plan: 727 forex pairs (comprehensive exotic coverage)

Major Pairs Include:

EUR/USD, GBP/USD, USD/JPY

USD/CHF, AUD/USD, USD/CAD

NZD/USD

Exotic Pairs: Access emerging market currencies in Pro plan

Forex-Specific Features

Session Overlay:

Asian session indicators

European session markers

New York session highlights

Swap/Rollover Calculations: Accurate overnight interest rate calculations for multi-day forex positions.

Correlation Analysis: Monitor correlated pairs (e.g., EUR/USD vs. GBP/USD) simultaneously.

Strategy Builder & Automation Features

One of FTO’s most powerful capabilities is custom strategy automation.

Custom Expert Advisors (EAs)

The platform supports fully automated trading strategies:

Supported Languages:

Python: Write strategies in Python with full backtesting support

SQL: Create database-driven rule engines

Custom EA Upload: Import proprietary expert advisors

Figure 7. Forex Tester Online: Strategy Builder Setup

Important Note: Custom indicators and EAs are not available in the Free Demo or Blind Testing

Mode. These features require a paid subscription (Starter or Pro plan).

Automation Capabilities

What You Can Automate:

Entry signal generation

Exit signal execution

Position sizing calculations

Risk management rules

Multi-timeframe confirmations

Indicator-based filters

Limitations: The platform documentation doesn’t clearly specify computational limits (CPU time, memory constraints) for custom code. Complex strategies may encounter performance boundaries, though specific limits aren’t published.

Strategy Optimization

While FTO supports strategy testing, explicit parameter optimization features (sweep testing, walk-forward analysis) aren’t prominently documented. Traders seeking advanced optimization may need to:

Manually test parameter variations

Export results for external analysis

Use third-party optimization tools

Creating a Custom Strategy

Workflow:

Define entry and exit logic

Code strategy in Python or SQL

Upload to FTO platform

Select assets and timeframes

Run backtest simulation

Analyze performance metrics

Refine and retest

Integration Considerations:

API documentation is limited in public materials

Advanced users should contact support for technical specifications

Testing complex strategies recommended before full commitment

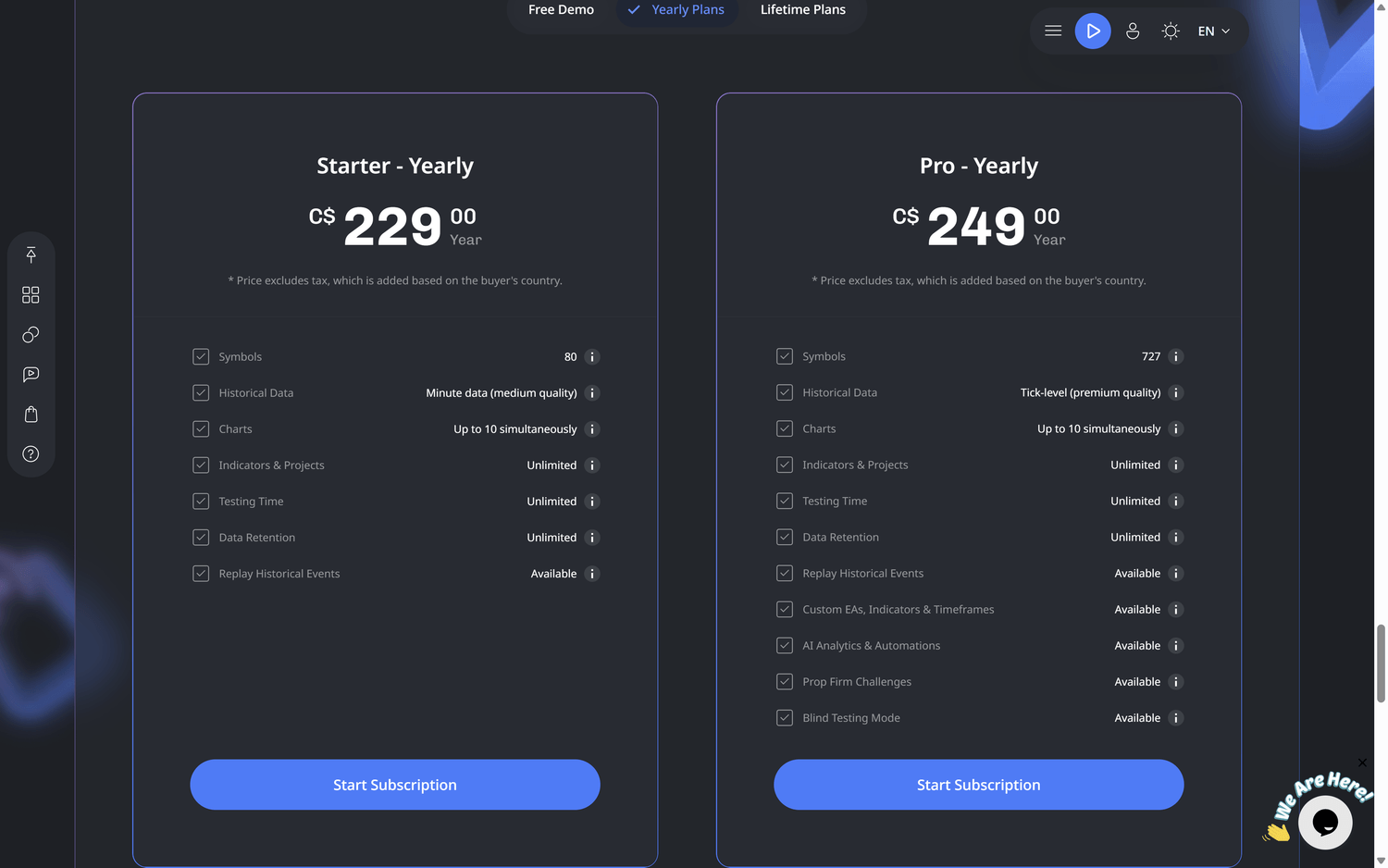

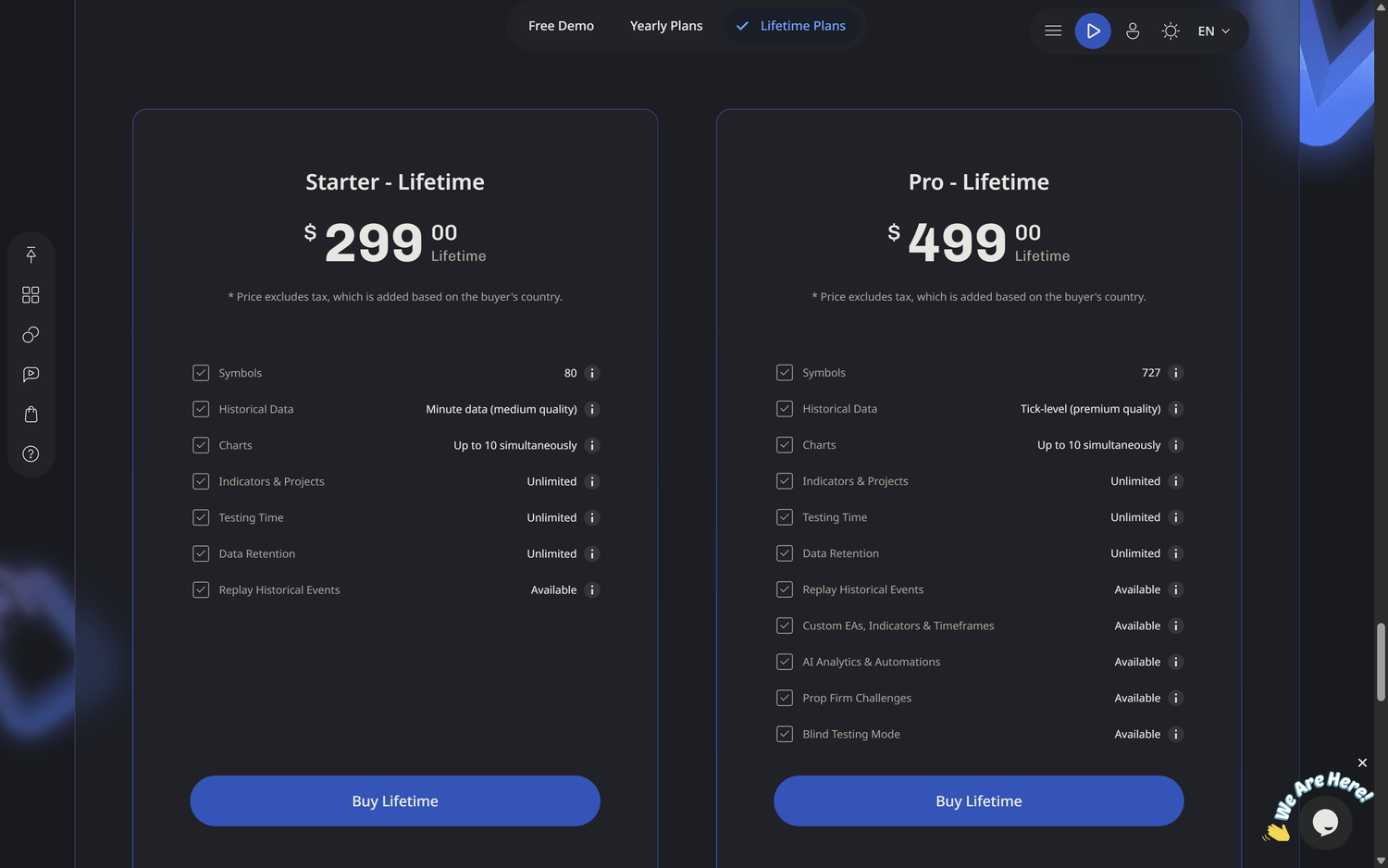

Pricing & Subscription Plans

Forex Tester Online offers four paid subscription tiers plus a limited free demo.

Free Demo Plan

What's Included:

1 month of historical data for 2 forex pairs: EURUSD and USDJPY

Manual backtesting mode only

Access to core interface with basic toolset

Limited to 2 currency pairs (no crypto or stocks)

Limitations:

Projects cannot be saved

Custom indicators and Custom EAs not supported

Prop Firm Mode unavailable

Blind Testing Mode unavailable

No cryptocurrency or stock symbols

Best For: Evaluating the platform interface before purchasing

Starter - Yearly Subscription

Figure 8. Forex Tester Online: Yearly Plans

Price: $229/year. Price excludes tax, which varies by buyer's country

Features:

80 symbols across forex, crypto, stocks, commodities

Minute-level data (medium quality OHLC bars)

Up to 10 charts simultaneously

Unlimited indicators & projects

Unlimited testing time

Unlimited data retention

Replay historical events feature included

30-day money-back guarantee

Best For: Individual traders focused on major instruments, acceptable with minute-level precision

Pro - Yearly Subscription

Price: $249/year. Price excludes tax, which varies by buyer's country

Features:

727 symbols - comprehensive market coverage

Tick-level data (premium quality - every price change)

Up to 10 charts simultaneously

Unlimited indicators & projects

Unlimited testing time

Unlimited data retention

Replay historical events

Custom EAs, indicators & timeframes supported

AI Analytics & Automations available

Prop Firm Challenges simulation

Blind Testing Mode included

30-day money-back guarantee

Best For: Professional traders requiring maximum precision, extensive symbol coverage, and advanced features

Starter - Lifetime License

Figure 9. Forex Tester Online: Lifetime License

Price: $299 one-time payment. Price excludes tax, which varies by buyer's country

Features:

Same as Starter Yearly plan

One-time payment - no recurring fees

Lifetime access to platform

30-day money-back guarantee

Best For: Traders who prefer one-time purchases and long-term platform commitment

Pro - Lifetime License

Price: $499 one-time payment. Price excludes tax, which varies by buyer's country

Features:

Same as Pro Yearly plan

One-time payment - no recurring fees

Lifetime access to platform

30-day money-back guarantee

Best For: Serious traders seeking maximum features with lifetime access

Value Comparison:

| Plan | Annual Cost (Year 1) | Annual Cost (Year 3) | Break-Even |

|---|---|---|---|

| Starter Yearly | $229 | $687 | N/A |

| Starter Lifetime | $299 | $299 | 1.3 years |

| Pro Yearly | $249 | $747 | N/A |

| Pro Lifetime | $499 | $499 | 2.0 years |

Recommendation for Crypto Traders:

For serious cryptocurrency backtesting, the Pro plan is essential because:

Tick-level data captures crypto's rapid price movements

727 symbols provides access to all major and minor crypto pairs

Custom EA support enables automated strategy testing

Lifetime vs. Yearly Decision:

Choose Lifetime if you plan to use the platform for 2+ years

Choose Yearly if you're testing the platform's long-term value

Lifetime makes economic sense for committed traders

30-Day Money-Back Guarantee:

All paid plans include a full refund window, allowing risk-free evaluation.

How Pricing Compares

vs. TradingView:

TradingView Pro: $15-50/month ($180-600/year)

FTO offers lifetime option (no equivalent on TradingView)

FTO Pro Lifetime ($399) = ~2 years of TradingView Pro+

vs. Desktop Backtesting Software:

Many desktop platforms: $500-2,000+ one-time

FTO competitive, especially with cloud convenience

Pros and Cons

Advantages

✅ No Installation Required Access from any device with a browser - Windows, macOS, Linux, iPad, etc.

✅ Cloud-Based Project Storage Unlimited project saves with automatic cloud synchronization

✅ Tick-Level Data Precision Pro plan captures every price change for realistic simulation (crucial for crypto/scalping)

✅ Variable Speed Testing Compress months of market action into hours of testing

✅ Lifetime License Option One-time payment available (rare in modern SaaS)

✅ Comprehensive Asset Coverage Test across crypto, stocks, forex, commodities, and indices

✅ Jump to Date Feature Instantly teleport to specific historical moments (massive time-saver)

✅ Multi-Chart Synchronization Analyze correlations across 10 simultaneous charts

✅ Custom EA/Strategy Support Python and SQL integration for algorithmic traders

✅ 30-Day Money-Back Guarantee Risk-free evaluation period

Disadvantages

❌ No Crypto in Free Demo Cannot test Bitcoin or Ethereum without paid subscription

❌ Limited Public Automation Documentation API specifications and computational limits not clearly published

❌ No Built-In Walk-Forward/Monte Carlo Advanced optimization features not prominently available

❌ Internet Dependency Requires stable connection (cloud-based architecture)

❌ Potential Pricing Changes Platform is relatively new - future pricing/versioning uncertain

❌ Learning Curve More complex than basic charting platforms

❌ No Live Trading Integration Purely backtesting - no broker connection for live execution

❌ Unclear Data Update Policy Frequency of historical data updates not clearly specified

Honest Assessment

Forex Tester Online excels as a dedicated backtesting platform but isn't a complete trading solution. Traders will still need:

Live charting platform (e.g., TradingView)

Broker account for execution

Risk management tools for live trading

Think of FTO as your strategy development laboratory, not your entire trading infrastructure.

Who Should Use Forex Tester Online?

Ideal User Profiles

✅ Cryptocurrency Day Traders & Scalpers

Need tick-level precision for volatile crypto markets

Test strategies across multiple timeframes

Validate high-frequency approaches without capital risk

✅ Swing Traders (Crypto & Stocks)

Test multi-day position strategies

Analyze overnight risk in crypto's 24/7 market

Validate entry/exit timing across market cycles

✅ Algorithmic Traders

Develop and test automated strategies

Python/SQL integration for custom logic

Performance validation before live deployment

✅ Strategy Developers

Create proprietary trading systems

Rapid iteration and refinement

Portfolio diversification testing

✅ Trading Educators & Mentors

Demonstrate strategy concepts

Share projects with students

Validate teaching methodology

✅ Part-Time Traders

Cloud access from any device

Test during limited available time

Compress learning curve significantly

Less Suitable For

❌ Complete Trading Beginners

Steep learning curve without basic trading knowledge

Better to start with free educational resources

Consider after understanding basic technical analysis

❌ Buy-and-Hold Investors

Platform optimized for active trading strategies

Limited value for long-term passive approaches

Fundamental analysis tools minimal

❌ High-Frequency Traders (Sub-Second)

Execution environment limitations

Computational constraints may impact complex algos

Consider dedicated HFT infrastructure

❌ Those Needing Live Trading Integration

No broker connections

Purely backtesting/simulation

Requires separate execution platform

❌ Traders on Unstable Internet

Cloud dependency requires reliable connection

Performance degrades with poor bandwidth

Final Verdict

Overall Rating: 4.2/5 Stars

Breakdown:

Cryptocurrency Backtesting: 4.5/5 (tick-level data, 31 pairs, excellent for crypto)

Stock Market Testing: 4.0/5 (solid coverage, fundamental event integration)

Forex Simulation: 4.3/5 (comprehensive pairs, accurate spread modeling)

Ease of Use: 3.8/5 (moderate learning curve, powerful once mastered)

Value for Money: 4.5/5 (lifetime option, competitive pricing)

Documentation: 3.5/5 (basic features well-covered, advanced automation needs clarity)

The Bottom Line

Forex Tester Online delivers a robust, cloud-based backtesting environment that successfully bridges the gap between theoretical strategy development and real-world trading execution. For cryptocurrency traders specifically, the platform offers compelling advantages:

What Makes It Shine for Crypto Traders:

Tick-level precision captures crypto's volatile price action

24/7 market simulation mirrors crypto's always-on nature

No installation barriers - start testing immediately

Lifetime pricing option provides long-term value

Multi-crypto portfolio testing capabilities

Where It Falls Short:

No crypto access in free demo (limits evaluation)

Automation documentation could be more comprehensive

Advanced optimization features not prominently available

Internet dependency may frustrate some users

Who Should Buy?

Strongly Recommended For:

Crypto day traders and scalpers needing tick-level precision

Strategy developers willing to invest in proper backtesting

Traders seeking lifetime platform access

Anyone who's lost money from untested strategies

Consider Alternatives If:

You need live trading integration

Your primary platform is TradingView and you only need occasional replay

You're a complete beginner (learn basics first)

You require sub-second HFT capabilities

Investment Decision Framework

Choose Pro Lifetime ($499) if:

Cryptocurrency is your primary market

You need maximum symbol coverage (727)

Tick-level data essential for your strategies

Planning to use platform for 2+ years

Want all advanced features (custom EAs, blind testing, prop firm challenges)

Choose Starter Lifetime ($299) if:

Focus on major crypto pairs only

Minute-level data sufficient for your timeframe

Budget-conscious but want lifetime access

Testing primarily swing trading strategies

Choose Yearly Plans if:

Want to evaluate platform over longer period

Uncertain about long-term commitment

Prefer spreading costs across time

The 30-Day Challenge

With the money-back guarantee, here's a suggested evaluation approach:

Week 1: Learn the interface, import your favorite strategies

Week 2: Backtest strategies across different market periods

Week 3: Refine and optimize based on results

Week 4: Make final decision on long-term value

If the platform saves you from even one bad trade that would have cost $500-1,000, it's already paid for itself.

Final Recommendation

For cryptocurrency traders serious about developing profitable, tested strategies, Forex Tester Online represents a valuable investment. The platform's tick-level data, variable speed testing, and cloud accessibility create an efficient strategy development environment.

Is it perfect? No. Documentation gaps exist, particularly for advanced automation. Internet dependency won't suit everyone.

Is it worth it? For committed traders willing to properly backtest before risking capital: absolutely.

The harsh truth of trading: untested strategies are expensive experiments. Forex Tester Online provides the laboratory to fail fast, fail cheap, and ultimately succeed with validated approaches.

Risk-Free Next Step: Start your free demo and evaluate if FTO fits your trading development workflow. The 30-day money-back guarantee on paid plans removes downside risk.

Remember: the cost of one poorly-executed trade often exceeds the platform's lifetime price. Smart traders invest in proper strategy validation. The question isn't whether you can afford backtesting software—it's whether you can afford to trade without it.

Sergey Buzz

Last Updated: October 2025

Disclosure: This review contains affiliate links. If you purchase through these links, we may earn a commission at no additional cost to you. All opinions and assessments are based on objective platform evaluation and publicly available information.