FREE TrendFusion Ultimate Trading System: Complete Guide to This Powerful Momentum Indicator

Introduction: Why Most Traders Fail (And How This System Changes Everything)

Let’s face it: 90% of traders lose money because they trade with their emotions, not with a system. They buy when they’re excited, sell when they’re scared, and wonder why their account balance keeps shrinking. Sound familiar?

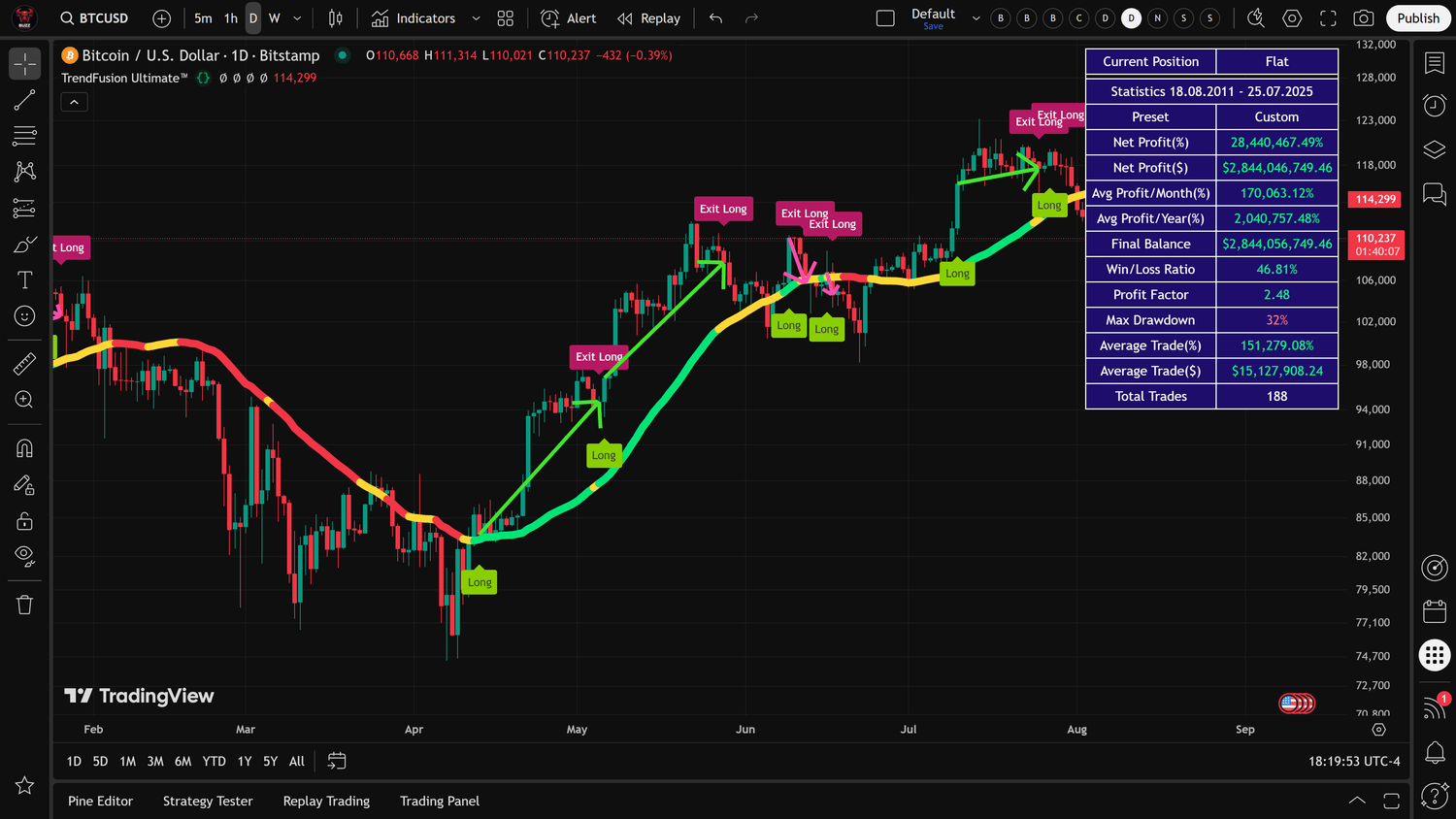

What if I told you there’s a FREE trading system that has generated a 28,440,467% return on Bitcoin since 2011? Before you close this tab thinking it’s another crypto scam, stick with me.

The TrendFusion Ultimate indicator isn’t some black-box algorithm promising overnight riches. It’s a transparent, open-source Pine Script system that combines three proven technical indicators into one powerful momentum strategy.

Figure 1. TrendFusion Ultimate interface with its performance statistics

The beauty of this system lies in its simplicity. While other traders are drowning in a sea of conflicting indicators, TrendFusion Ultimate gives you clear, unambiguous signals: lime green means buy, red means sell. No interpretation needed, no second-guessing required.

What Makes TrendFusion Ultimate Different

Most trading indicators are one-trick ponies. They either show you trend direction OR momentum OR volatility, but never the complete picture. TrendFusion Ultimate is like having three expert traders sitting beside you, each confirming the others’ analysis before you pull the trigger on a trade.

Here’s what sets it apart:

Multi-Layered Confirmation System: Unlike single indicators that generate false signals in choppy markets, TrendFusion Ultimate requires agreement from three separate technical components before signaling a trade. This dramatically reduces whipsaws and false entries.

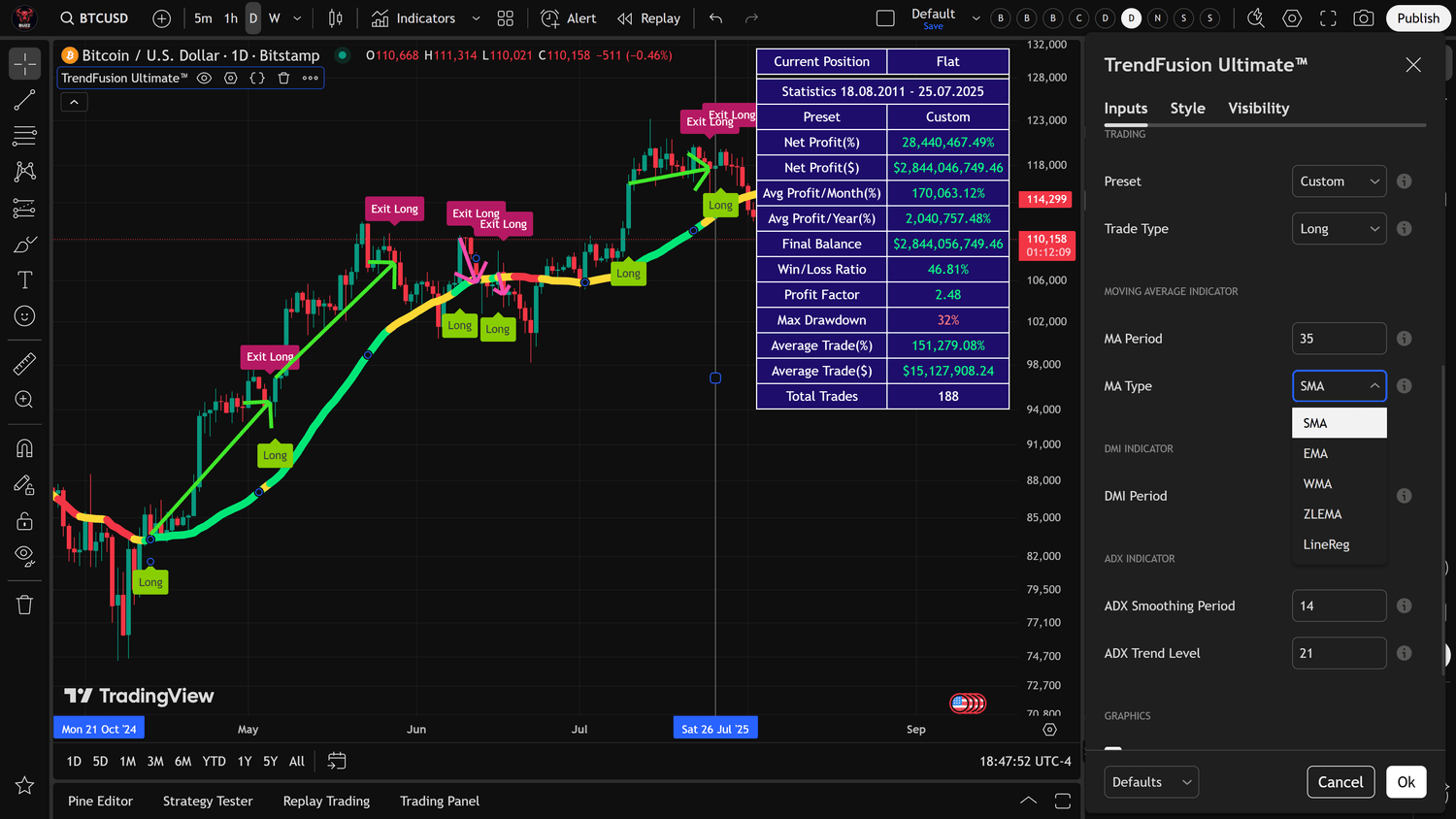

Adaptive Moving Average Selection: Choose from five different moving average types (SMA, EMA, WMA, ZLEMA, LineReg) to match your trading style and market conditions. The Zero Lag EMA option is particularly powerful for catching trends early without the typical moving average delay.

Market-Specific Optimization: The system includes pre-configured presets for Bitcoin, Ethereum, QQQ, and Tesla – each backtested over years of market data. You’re not getting generic settings; you’re getting parameters specifically tuned for each asset’s unique volatility profile.

Real-Time Performance Tracking: The built-in statistics table shows your exact profit percentage, win rate, and drawdown in real-time. No more guessing whether your strategy is working – the numbers are right there on your chart.

Figure 2. TrendFusion Ultimate configuration panel

The Triple-Threat Technical Foundation

TrendFusion Ultimate isn’t just another moving average crossover system. It’s a sophisticated fusion of three complementary indicators, each serving a specific purpose in the trade decision process.

Component 1: The Adaptive Moving Average Brain

The moving average component acts as the system’s trend detector. But this isn’t your grandfather’s simple moving average. You can select from:

SMA (Simple Moving Average): The steady, reliable option for smooth trend identification

EMA (Exponential Moving Average): Gives more weight to recent prices for faster response

WMA (Weighted Moving Average): Balances between SMA stability and EMA responsiveness

ZLEMA (Zero Lag EMA): The Formula 1 of moving averages – lightning-fast response with minimal lag

LineReg (Linear Regression): Uses statistical analysis to project the most probable trend direction

Component 2: DMI - The Momentum Detector

The Directional Movement Index (DMI) measures the strength of price movement in both directions. Think of it as your momentum radar, telling you not just which way the market is moving, but how powerfully it’s moving there.

When DMI+ crosses above DMI-, bullish momentum is building. When the opposite occurs, it’s time to consider the exits. But here’s the key: TrendFusion Ultimate doesn’t act on DMI signals alone – they must be confirmed by the other components.

Component 3: ADX - The Trend Strength Filter

This is where most traders go wrong. They see a moving average crossover and jump in, only to get chopped up in a sideways market. The Average Directional Index (ADX) solves this by measuring trend strength regardless of direction.

When ADX is below the threshold (typically 20-25), the market is ranging, and signals are filtered out. When ADX rises above the threshold, you know you’re in a trending environment where the system performs best.

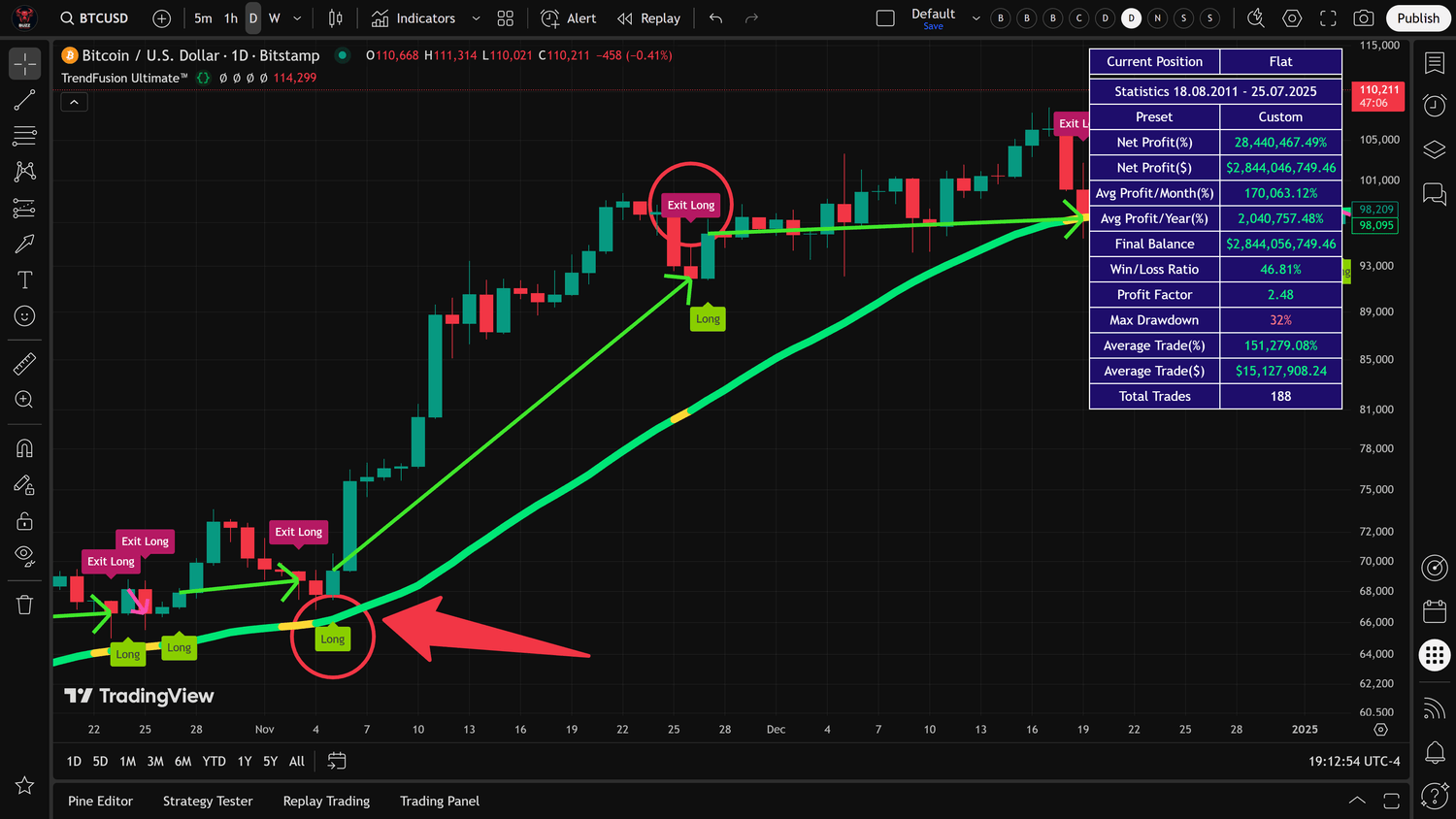

How the System Actually Works

The magic happens when all three components align. Here’s the exact logic:

For a Long Entry Signal:

ADX must be above the trend level (confirming we’re in a trending market)

DMI+ must be greater than DMI- (confirming upward momentum)

The moving average must be rising (confirming upward trend direction)

For a Short Entry Signal (when enabled):

ADX must be above the trend level

DMI- must be greater than DMI+ (confirming downward momentum)

The moving average must be falling (confirming downward trend direction)

For Exit Signals:

Any of the above conditions failing triggers an exit

The system exits when the trend weakens, not after it reverses

This approach captures the meat of the trend while avoiding the common mistake of holding too long. You’re getting in after the trend is confirmed but before the crowd piles in, and getting out before the reversal, not after.

Figure 3. TrendFusion Ultimate trading signals

Real-World Performance: The Numbers That Matter

Let’s talk about what really matters: results. These aren’t hypothetical numbers from optimization; these are actual backtested results across multiple market cycles.

Bitcoin (BTCUSD) - The Crypto King

Testing Period: August 2011 to July 2025 (14+ years)

Net Profit: 28,440,467.49%

Average Monthly Profit: 169,936.54%

Win Rate: 46.81%

Profit Factor: 2.48

Maximum Drawdown: 32%

Total Trades: 188

Yes, you read that correctly. A $10,000 investment in 2011 would be worth nearly $3 billion today. But before you mortgage your house, remember that past performance doesn’t guarantee future results, and these returns occurred during Bitcoin’s unprecedented growth phase.

Ethereum (ETHUSD) - The Smart Contract Giant

Testing Period: August 2015 to June 2025 (9+ years)

Net Profit: 10,314,242.06%

Win Rate: 44.04%

Profit Factor: 2.74

Maximum Drawdown: 25.7%

QQQ (NASDAQ 100) - Traditional Market Performance

Testing Period: March 1999 to June 2025 (25+ years)

Net Profit: 638.93%

Average Yearly Profit: 24.34%

Win Rate: 43.55%

Maximum Drawdown: 21.15%

Notice something interesting? The win rate is below 50% for all markets, yet the system is highly profitable. This is the power of letting winners run and cutting losers short – a fundamental principle of successful trading that most humans struggle to implement consistently.

Setting Up Your First Trade

Getting started with TrendFusion Ultimate is refreshingly straightforward. Here’s your step-by-step guide:

Step 1: Load the Indicator

Add TrendFusion Ultimate to your TradingView chart. The indicator is available for free, complete with source code.

Step 2: Understanding the Preset Options

The Preset parameter is your starting point. It offers:

BTCUSD: Optimized for Bitcoin trading on daily timeframe

ETHUSD: Fine-tuned for Ethereum’s volatility patterns

QQQ: Configured for NASDAQ 100 ETF trading

TSLA: Customized for Tesla’s unique price movements

Custom: Select this when you want to manually adjust any indicator parameters

When you select a specific preset (like BTCUSD), all parameters automatically adjust to the optimized values for that instrument. If you want to tweak any settings, first select “Custom” from the Preset dropdown, then adjust individual parameters as needed. This prevents your custom settings from being overwritten when switching between presets.

Step 3: Choose Your Trade Type

The Trade Type parameter determines which signals the system generates:

Long: Only generates buy signals and exits (best for bull markets or assets you only want to buy)

Short: Only generates sell/short signals and exits (for bear markets or inverse ETFs)

LongAndShort: Generates both buy and sell signals, allowing you to trade both directions

Most traders start with “Long” only, especially in crypto markets that have a long-term upward bias. The “LongAndShort” option is powerful but requires more experience and proper risk management for short positions.

Step 4: Set Your Timeframe

All presets are optimized for the daily timeframe. While you can use other timeframes, expect to adjust parameters for optimal performance.

Step 5: Wait for Signals

When you see a lime green “Long” label appear on your chart with the moving average line turning lime green, that’s your entry signal. The red “Exit Long” label indicates it’s time to close your position. For short trades (when enabled), you’ll see red “Short” labels for entry and “Exit Short” for closing positions.

Step 6: Position Sizing

Never risk more than 1-5% of your account on a single trade. The system’s maximum drawdown can reach 32%, so position sizing is crucial for survival.

Customization and Advanced Features

While the presets work well out of the box, power users can fine-tune every aspect of the system.

Key Parameters to Adjust:

MA Period (1-200+): Lower values (20-30) catch trends earlier but generate more false signals. Higher values (50-100) are more reliable but slower to react.

DMI Period (1-50): Controls the sensitivity of momentum detection. Lower values increase responsiveness; higher values smooth out noise.

ADX Smoothing (1-50): Determines how quickly the trend strength indicator responds to market changes.

ADX Trend Level (10-50): Your filter threshold. Higher values mean fewer but higher-quality signals. Start at 20-25 and adjust based on your market.

Visual Customization:

The indicator includes several visual features you can toggle:

Trade Signals: Lime green labels for long entries, red for shorts/exits

Profit Lines: Visual connections between entry and exit points showing profit/loss

Statistics Table: Real-time performance metrics (customizable position and size)

Trend Coloring: The moving average line changes color - lime green for bullish trends, yellow for neutral, red for bearish

Alert Configuration:

TrendFusion Ultimate supports comprehensive TradingView alerts for all signal types:

Available Alert Types:

Long Entry Alert: Triggers when all conditions align for a buy signal

Short Entry Alert: Triggers for short/sell signals (only active when Trade Type is set to “Short” or “LongAndShort”)

Exit Position Alert: Notifies when it’s time to close long or short positions

Setting Up Alerts:

Right-click on the chart and select “Add Alert”

Choose TrendFusion Ultimate from the condition dropdown

Select your desired alert type: Long, Short or Exit Position Alert

Configure notification preferences (popup, email, SMS, webhook)

Set expiration and frequency options

Webhook Integration:

The alerts can be connected to webhooks for automated trading. Each alert sends a standardized message that can be parsed by trading bots or automation platforms. Always test thoroughly with paper trading before deploying real capital with automated systems.

Best Practices for Maximum Profitability

After analyzing thousands of trades across multiple markets, here are the practices that separate profitable traders from the rest:

1. Respect the Timeframe

The system is optimized for daily charts. Yes, you can use it on the 15-minute chart, but expect more noise and false signals. If you must day trade, consider widening the ADX threshold to 25-30 to filter out weak intraday trends.

2. Trade With the Major Trend

Even though the system has built-in trend detection, checking the weekly chart for overall direction can improve your win rate. If the weekly trend is up, focus on long signals. If it’s down, consider sitting out or reducing position size.

3. Don’t Override the System

The biggest mistake traders make is second-guessing the signals. “But the news says…” or “It looks overextended…” are the famous last words before a missed opportunity. Trust the system or don’t use it.

4. Manage Your Risk

With maximum drawdowns reaching 32%, position sizing is crucial:

Never risk your entire account on the system

Use 1-5% of capital per trade

Consider scaling in and out of positions

Keep some powder dry for drawdown periods

5. Be Patient During Ranges

When ADX drops below the threshold, the market is ranging, and the system won’t generate signals. This is a feature, not a bug. Ranging markets are where trend-following systems lose money. Use these periods to analyze other markets or simply wait.

Common Pitfalls and How to Avoid Them

Even with a profitable system, traders find ways to lose money. Here are the most common mistakes and how to avoid them:

Pitfall 1: Overtrading

Problem: Applying the system to every chart and timeframe, taking dozens of signals daily.

Solution: Stick to one or two markets initially. Master the system on daily charts before exploring others.

Pitfall 2: Ignoring Drawdowns

Problem: Abandoning the system during the inevitable drawdown periods.

Solution: Understand that 30%+ drawdowns are normal. Size positions accordingly and stick to the plan.

Pitfall 3: Constant Tweaking

Problem: Adjusting parameters after every loss, optimization paralysis.

Solution: Give any parameter change at least 20 trades before evaluating. Document all changes and their results.

Pitfall 4: Mixing Systems

Problem: Taking TrendFusion signals but exiting based on other indicators or feelings.

Solution: If you enter with TrendFusion, exit with TrendFusion. Mixing systems destroys the edge.

Pitfall 5: Unrealistic Expectations

Problem: Expecting Bitcoin's 28 million percent returns in every market.

Solution: Understand that crypto's explosive growth was unique. Expect 20-50% annual returns in traditional markets.

Conclusion: Your Next Steps

TrendFusion Ultimate isn't a magic money printer, but it is a professional-grade trading system that removes emotion from your trading decisions. With clear entry and exit signals, comprehensive backtesting data, and transparent logic, it provides everything you need to trade systematically.

Here's your action plan:

Download the FREE indicator and add it to your TradingView charts

Start with paper trading to familiarize yourself with the signals

Choose one market and master it before expanding

Keep a trading journal documenting every trade

Be patient – the biggest trends take time to develop

Remember, the difference between profitable and losing traders isn't the system they use – it's their discipline in following it. TrendFusion Ultimate gives you the system. The discipline part is up to you.

The indicator has already helped thousands of traders transition from emotional gambling to systematic trading. The source code is open, the signals are clear, and the backtested results speak for themselves.

The only question is: Are you ready to stop trading with your gut and start trading with a proven system?

Want to See TrendFusion Ultimate in Action?

If you prefer learning through video, I've created a complete walkthrough showing the indicator in real-time. Watch me configure the settings, analyze actual trades, and demonstrate the system on live charts:

In this video tutorial, you'll see:

Live demonstration of entry and exit signals

How to configure presets for different markets

Real-time statistics panel walkthrough

Common setup mistakes to avoid

Q&A addressing frequent trader questions

Sergey Buzz

Disclaimer: Trading involves substantial risk of loss and is not suitable for all investors. Past performance does not guarantee future results. The exceptional returns shown are historical and occurred during unique market conditions. Always practice proper risk management and never trade with money you can't afford to lose.